Insurance coverage guidelines are a crucial portion of contemporary daily life, presenting security and peace of mind in an unpredictable globe. Whether It can be for your property, vehicle, wellness, or lifetime, insurance coverage insurance policies can provide fiscal protection in the event of an unexpected event. But what precisely are insurance policy policies, and How come we'd like them? This article will explore a variety of elements of insurance policies policies, breaking down their types, Gains, and worth in a means which is straightforward to understand. In case you are new to insurance policies or maybe hunting for a refresher, this tutorial can help you navigate the planet of insurance policies policies with assurance.

At its core, an insurance policy policy is really a contract amongst you and an insurance company. The insurance company agrees to supply economic coverage for certain pitfalls in exchange for regular payments named premiums. Quite simply, you pay a set amount of money to your insurance provider, and so they promise to assist deal with the fee if a thing goes Improper. Think about it like spending a small value to stay away from a Substantially greater fiscal burden Sooner or later.

Insurance For Entrepreneurs Fundamentals Explained

One of the more prevalent sorts of insurance plan insurance policies is automobile insurance coverage. Motor vehicle coverage allows deal with The prices associated with mishaps, theft, or damage to your car or truck. Sometimes, it may also provide liability protection, defending you when you are at fault in a collision that damages another person's home or will cause damage. Without having car coverage, an easy fender-bender could develop into a monetary nightmare, leaving you with highly-priced maintenance charges and health care charges.

One of the more prevalent sorts of insurance plan insurance policies is automobile insurance coverage. Motor vehicle coverage allows deal with The prices associated with mishaps, theft, or damage to your car or truck. Sometimes, it may also provide liability protection, defending you when you are at fault in a collision that damages another person's home or will cause damage. Without having car coverage, an easy fender-bender could develop into a monetary nightmare, leaving you with highly-priced maintenance charges and health care charges.Homeowners insurance coverage is yet another important plan for homeowners. Such a insurance policies guards your home and personal possessions against damages brought on by such things as fireplace, storms, or theft. If something transpires to your private home, homeowners insurance coverage may help purchase repairs or replacements. It also normally handles liability, Therefore if another person is wounded on your own property, you won't be still left footing the healthcare payments. With out this kind of insurance policy, you might deal with fiscal destroy right after an unlucky function.

Overall health insurance policies guidelines are Probably the most critical sort of insurance policy for individuals and family members. Medical costs can swiftly incorporate up, and devoid of health and fitness coverage, A lot of people might be struggling to afford to pay for required therapies. Wellbeing insurance coverage can help cover the cost of physician visits, medical center stays, prescription medicines, and preventive treatment. It also can supply monetary security against sudden clinical emergencies, like accidents or really serious diseases, which could in any other case drain your financial savings or put you in financial debt.

Lifestyle insurance policies is an additional essential coverage, specifically for people with dependents. Everyday living insurance makes sure that your family and friends are fiscally supported within the party of your Loss of life. The plan pays out a lump sum towards your beneficiaries, which may help include funeral expenditures, repay debts, or give income substitution. Even though it will not be by far the most nice matter to think about, obtaining existence insurance plan can supply comfort understanding that Your loved ones might be taken care of, even when you're no longer close to.

For people who very own a company, company insurance policies are important. These insurance policies secure against economic losses connected to such things as home harm, staff accidents, or lawsuits. With regards to the kind of organization, diverse insurance policy guidelines might be essential. As an example, a small business enterprise operator could possibly have to have standard legal responsibility insurance policy, even though a business in the healthcare sector may possibly call for specialised coverage like malpractice insurance coverage. It does not matter the business, getting the right organization insurance policies makes sure that you are covered in case of unpredicted occasions.

While insurance policy guidelines are built to safeguard us, they can be puzzling. There are several different types of protection, Every single with its personal guidelines and boundaries. Some procedures are necessary, like car or truck insurance policies, while some, like life insurance coverage, are optional but highly recommended. Knowledge the conditions and terms within your coverage is vital to ensuring you happen to be sufficiently secured. Normally study the fantastic print ahead of signing any insurance policies contract to stop surprises in the future.

Rates undoubtedly are a critical element of any insurance policy policy. Premiums are the quantity you pay back to take care of your insurance policy protection. They may vary extensively based upon elements like your age, wellness, the sort of protection you need, as well as your claims record. For instance, younger motorists usually fork out larger premiums for car or truck insurance policy due to their not enough practical experience behind the wheel. In the same way, somebody which has a history of professional medical situations may well confront bigger rates for well being insurance plan. Buying all around and comparing offers from different insurers will help you discover the greatest offer.

In addition to premiums, insurance coverage insurance policies frequently feature deductibles. A deductible is the quantity you should shell out outside of pocket before the insurance company starts covering prices. For example, if your automobile coverage contains a $five hundred deductible, you'll need to pay the very first $five hundred of any maintenance costs your self. Deductibles are usually greater for insurance policies with decreased premiums, so it's important to locate a stability that actually works for your price range. The lower the quality, the upper the deductible, and vice versa.

Promises are an essential Component of the insurance plan system. When something goes Improper, you file a declare with all your insurance provider to request payment for the loss or harm. The insurance company will then evaluate the situation and establish whether the assert is valid. If the assert is accepted, the insurance company pays out a percentage of the costs, minus any deductible. It is important to keep specific data and documentation, for example receipts or photographs, to help your declare and assure a clean process.

Insurance policy insurance policies usually feature exclusions, which are cases or gatherings that aren't covered from the plan. By way of example, many automobile coverage policies Really don't cover damage because of natural disasters like floods or earthquakes. Likewise, health insurance policies may well not protect particular elective treatments or solutions. It's vital to be aware of the exclusions within your coverage so You do not presume you might be coated if you're not. Should you be Doubtful, speak with an insurance policy agent or broker who can make clear any ambiguities.

Something to bear in mind when searching for insurance coverage is that The most cost effective selection is not the ideal. While It really is tempting to go with a Full info low-Expense plan, It really is critical to evaluate the protection it offers. From time to time, a lessen top quality may well indicate considerably less in depth coverage, leaving you subjected to economical hazards. On the other hand, a costlier policy may deliver much more extensive defense and assurance. Often weigh the pros and cons of different insurance policies prior to making a choice.

6 Easy Facts About Insurance Coverage Solutions Explained

When considering an insurance policy coverage, It is also significant to think about your extended-expression demands. For example, for anyone who is obtaining existence insurance coverage, you will need to pick a policy that should present satisfactory protection during your lifetime. Similarly, when you are obtaining overall health coverage, ensure the program will go over any potential health-related requires while you age. Insurance coverage needs can change with time, so It truly is a smart idea to evaluation your policies consistently and make adjustments as necessary.In combination with traditional insurance coverage guidelines, there are also specialised forms of insurance policies for market conditions. As an illustration, journey insurance coverage can protect you if something goes Improper for the duration of your journey, such as a flight cancellation or missing luggage. Pet insurance policies is another common solution, aiding pet proprietors go over the price of veterinary expenses. These specialized insurance policies present satisfaction for distinct aspects of lifetime, ensuring you might be safeguarded regardless of what comes about.

Understanding the function of an insurance agent or broker may also aid simplify the whole process of choosing the proper plan. An insurance plan agent signifies a person insurance company and may offer direction on the guidelines they promote. A broker, However, works with a number of insurance policy firms and will help you Assess options from distinctive providers. Equally agents and brokers can help you Find all info to find the proper protection for your needs, regardless of whether you're looking for auto, home, well being, or lifetime insurance plan.

An additional crucial factor to take into account when choosing an insurance policies plan would be the insurance provider's standing. Not all insurance plan businesses are designed equivalent, and a few are noted for delivering improved customer support or speedier promises processing than Other individuals. Ahead of committing to a policy, make an effort to study the insurance company's status. Take a look at client evaluations, ratings from unbiased businesses, and any problems submitted with regulatory bodies. A trustworthy insurer gives you confidence that you are in good hands.

While you navigate the world of insurance, it's important to understand that insurance is finally about safeguarding you along with your family and friends. While it may appear like an needless expenditure at times, having the appropriate insurance plan can stop a fiscal disaster from the celebration of a collision, ailment, or catastrophe. The peace of mind that comes along with knowing you might be protected is priceless. So, make the effort to comprehend your choices, Examine procedures, and Access now pick the coverage that most accurately fits your preferences. In spite of everything, insurance coverage is definitely an financial commitment in the foreseeable future security.

Our Comprehensive Insurance Solutions PDFs

In summary, insurance procedures are An important aspect of recent lifetime, furnishing money defense versus the uncertainties that arrive our way. From vehicle insurance to everyday living insurance, and every little thing in between, each coverage performs a crucial function in safeguarding our nicely-becoming. Regardless of whether you're a homeowner, a company owner, or just an individual searching to protect All your family members, getting the correct insurance policy coverage will make all the primary difference. So, don't wait for catastrophe to strike – be sure to're protected right now!

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Joshua Jackson Then & Now!

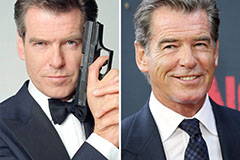

Joshua Jackson Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!